washington state capital gains tax repeal

Attorney General Bob Fergusons decision to attempt to bypass the. This initiative would repeal a 7 capital gains tax that was set to begin being collected in 2023.

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Washington State Representative Jim Walsh R-Aberdeen issued the following statement on the Advisory Vote 37.

. Msn back to. Governor Inslee signed Washingtons new capital gains tax the tax or the CGT into law on May 4 2021. While there currently isnt a capital gains tax should it.

Washington State Attorney General Bob Ferguson. The repeal side of an advisory vote on a capital gains tax approved by the state Legislature is out to an early lead following Tuesday nights. Jeremie Dufault R-Selah has introduced legislation that would repeal the states new controversial capital gains income tax that went into effect on Jan.

The repeal side of an advisory vote on a capital gains tax approved by the state Legislature is out to an early lead following Tuesday nights. Unfortunately the Washington State Supreme. SB 5096 was designed to impose a 7 tax on capital gains over 250000 with certain exceptions.

In his written decision issued Tuesday Douglas County. This tax only applies to individuals. 2 statewide ballot with 63 in favor of repealing the tax and 37 in favor of maintaining it the state elections office reported late Tuesday.

2 2021 841 PM. Washington state capital gains tax update. The capital-gains tax doesnt balance the tax code.

This bill would repeal the Washington state capital gains income tax Laws of 2021. Jay Inslee D signed legislation creating a 7 percent capital gains tax to take effect next year. Although the ballot measure asking voters to recommend.

Part IIA Brief Description of what the Measure does that has fiscal impact on the Courts No fiscal impact to the courts. State Measures Advisory Vote No. Last week a Douglas County Superior Court judge heard arguments in a lawsuit challenging the constitutionality of the capital gains income tax.

The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. Voters responded to a nonbinding advisory question on the Nov. IIB - Cash Receipt Impact None.

Washington state Attorney General Bob Ferguson. GeekWire file photo Dan DeLong In an effort to overturn a lower court ruling that blocked Washington states new capital gains tax the attorney generals office on Friday asked the states Supreme Court to. December 2 2021 by.

Washington Voters to Weigh in on New Capital Gains Income Tax. Washington Advisory Vote 37 was a question to voters on whether to maintain the capital gains income tax increase passed by the Legislature during the 2021 session. Washingtonians have told us several times over the years they do not want any form of a state income tax.

The legislature imposed without a vote of the people a 7 tax on capital gains in excess of 250000 with exceptions costing 5736000000 in its. The Washington Repeal Capital Gains Tax Initiative may appear on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. Attorney general seeks appeal to reinstate controversial law.

2 days agoThe measure simply put seeks to repeal any law in Washington state that imposes a capital gains tax. Judge Overturns Washington States New Capital Gains Tax. The answer from voters by a wide margin was no with a vote of 63 to 37.

On May 4th Gov. However individuals can be liable for the tax because of their ownership interest in a pass-through or disregarded entity. Repealing the capital gains income tax.

Former Washington Attorney General Rob McKenna made compelling arguments that seemed to resonate with Judge Brian Huber. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income tax set to go into effect on Jan. As many expected the state of Washington on March 25 bypassed the appellate court level and took its arguments directly to the state Supreme Court following Douglas County Superior Court Judge Brian Hubers ruling earlier this month striking down Washingtons new capital gains tax.

IIC Expenditures None. House Bill 1912 has been referred to the House Finance Committee. This tax only applies to individuals.

GeekWire File Photo Dan DeLong Seeking to overturn a lower court ruling blocking Washington states new capital gains tax the attorney generals office on Friday asked the state Supreme Court to take up the case on direct appeal. The state of Washington enacted a capital gains tax on individuals who recognize gain from the sale of long-term capital assets. Advisory Vote 37 was a non-binding question asking voters to advise the legislature on whether to uphold or repeal Senate Bill 5096 passed by the Washington State Legislature in the 2021 session.

It just adds another layer. Washington state voters overwhelmingly voted to disapprove of an excise tax on capital gains that takes effect in 2022. Share on Facebook Share on Twitter.

AP A judge has overturned a new capital gains tax on high profit stocks bonds and other assets that was approved by the Washington Legislature last year ruling that it is an unconstitutional tax on income. On November 2nd Washington lawmakers will learn what voters think about it. Ellings and John J.

With strong revenue projections and operating budgets already leaping. The CGT imposes a 7 long-term capital gains tax on the voluntary sale or exchange of stocks bonds and other capital assets that were held for more than one year where the profit exceeds.

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

No Constitutional Right To Be Ladies

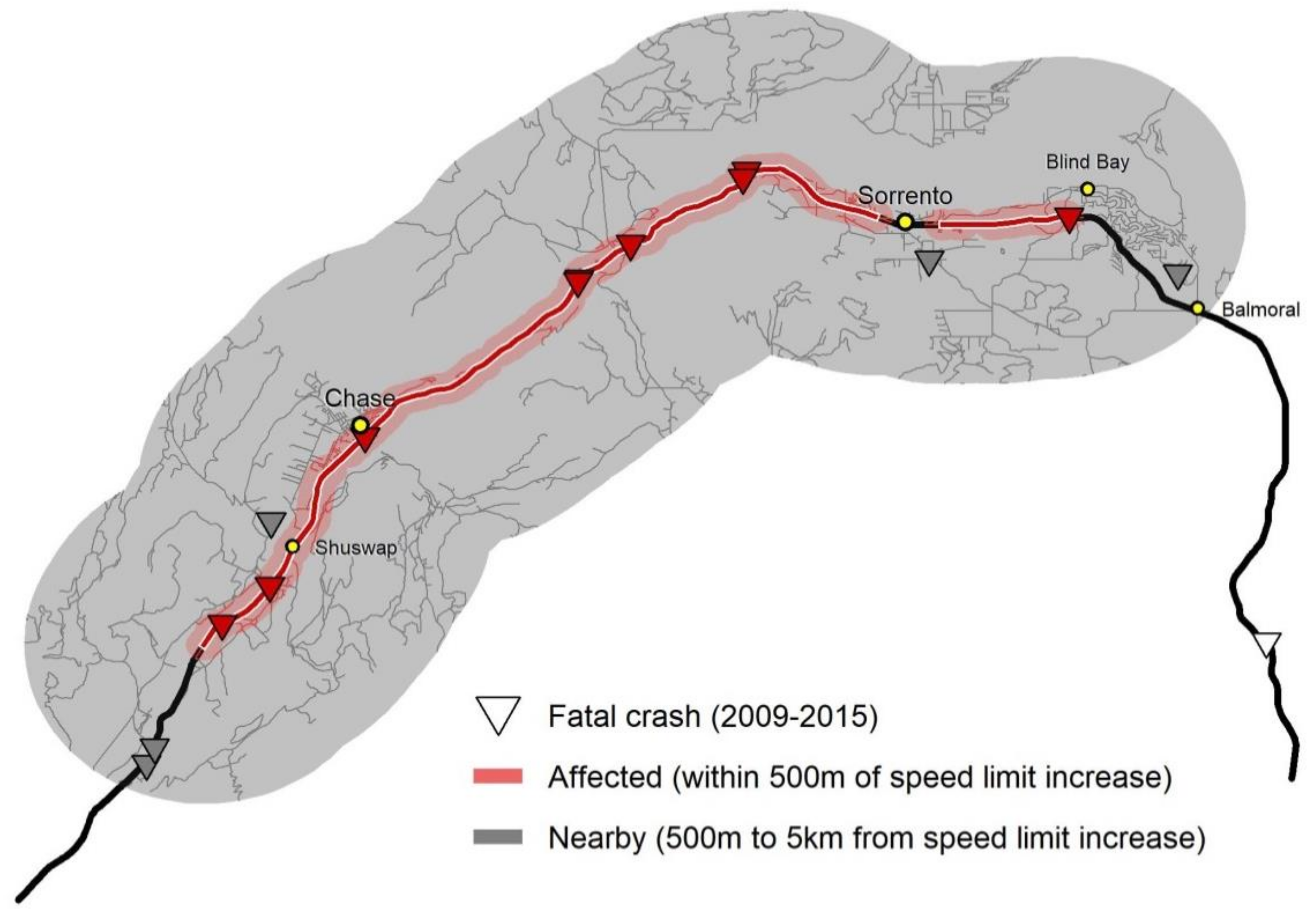

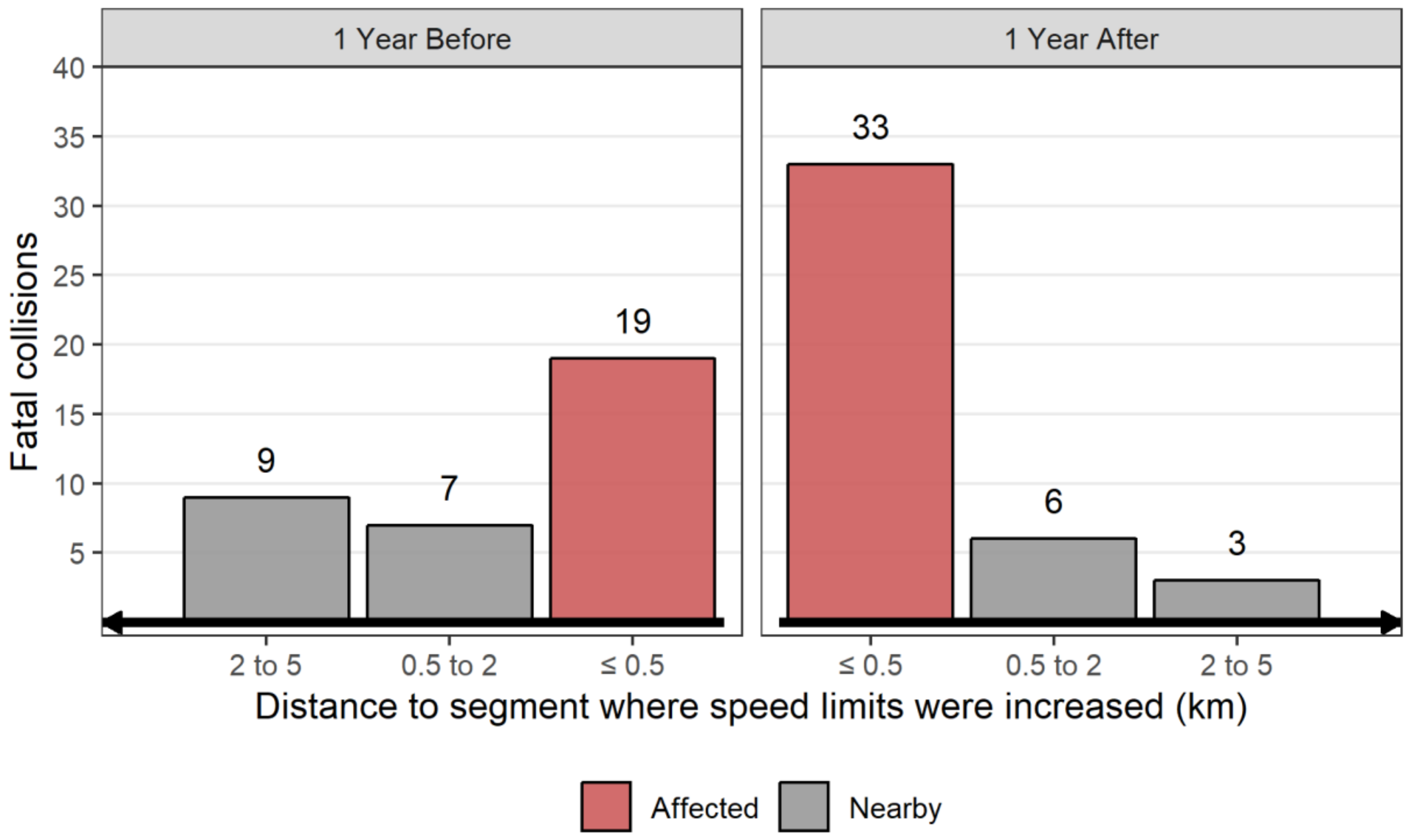

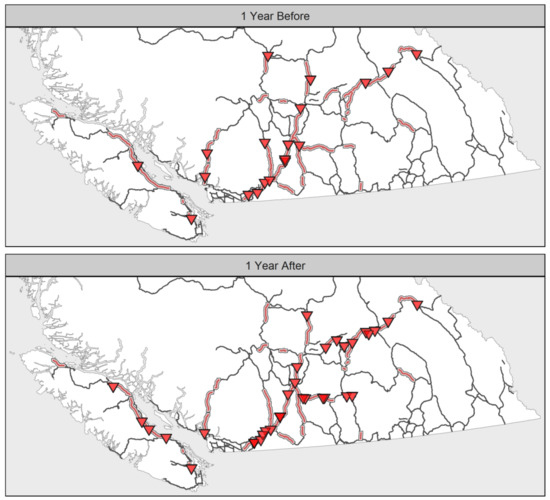

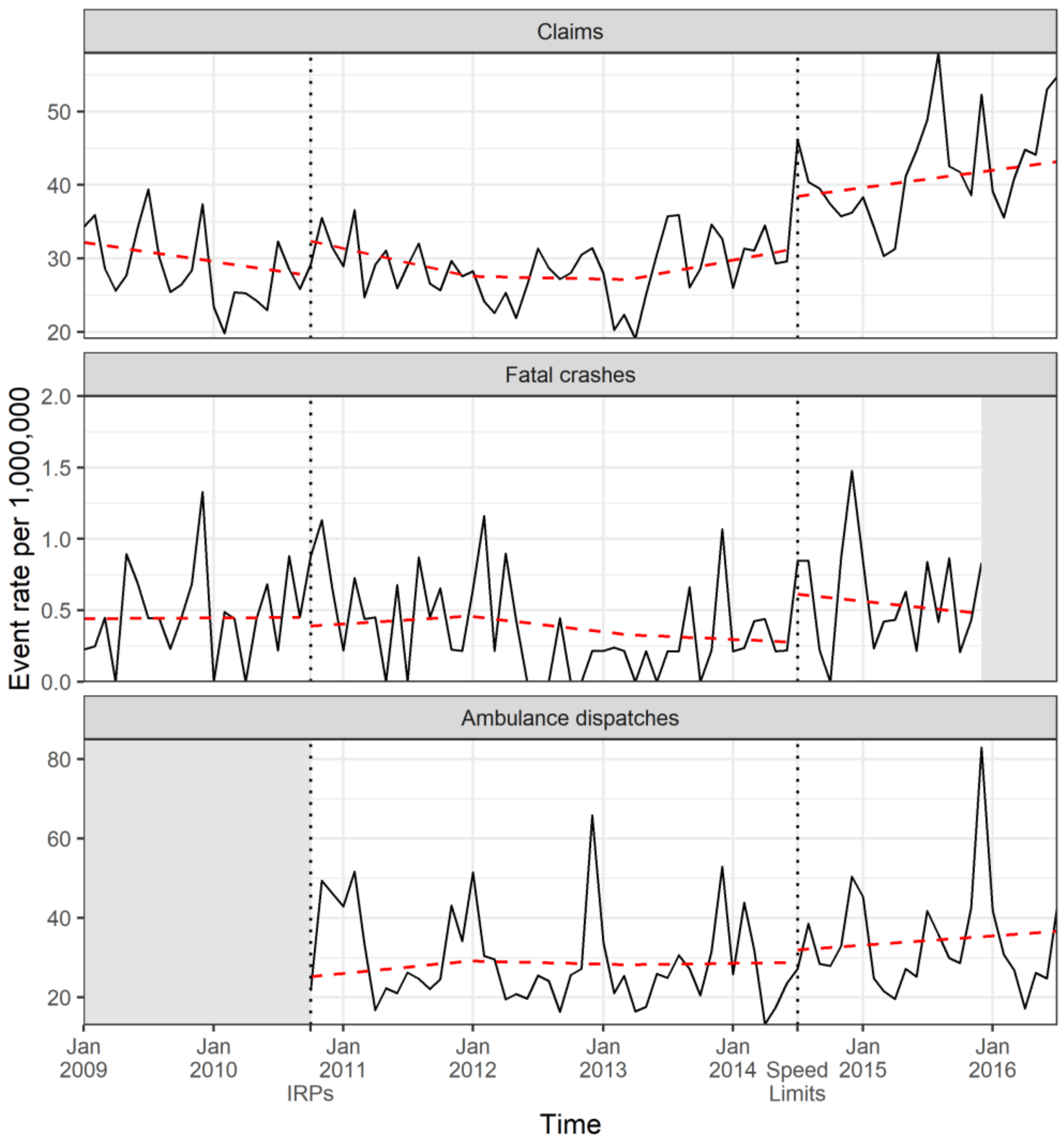

Sustainability Free Full Text Road Safety Impact Of Increased Rural Highway Speed Limits In British Columbia Canada Html

End Of Life Drupal 8 And The Upgrade To Drupal 9

The Campaign Led By Pmmodi Is Called Sandesh2soldiers Persuading The Masses To Send Good Wishes Through Letters And Messages To The Indianarmy T Pinteres

End Of Life Drupal 8 And The Upgrade To Drupal 9

Sustainability Free Full Text Road Safety Impact Of Increased Rural Highway Speed Limits In British Columbia Canada Html

During National School Bus Safety Week Officials In Maryland Are Bringing To Light A Problem That Does Not Seem To Be School Bus Safety School Bus Bus Safety

The Campaign Led By Pmmodi Is Called Sandesh2soldiers Persuading The Masses To Send Good Wishes Through Letters And Messages To The Indianarmy T Pinteres

Democratic Group Pledges Millions For State Legislative Wins

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Sustainability Free Full Text Road Safety Impact Of Increased Rural Highway Speed Limits In British Columbia Canada Html

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Sustainability Free Full Text Road Safety Impact Of Increased Rural Highway Speed Limits In British Columbia Canada Html

Meet The Guys Who Tape Trump S Papers Back Together Filing System Informative Presidents

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

The Campaign Led By Pmmodi Is Called Sandesh2soldiers Persuading The Masses To Send Good Wishes Through Letters And Messages To The Indianarmy T Pinteres